Valuation is entering a danger zone

Ethereum is negotiated at only 2% below its summit of $ 4,878, but the latest health analysis warns that chain metrics flash the warning signals for potential prices.

Summary

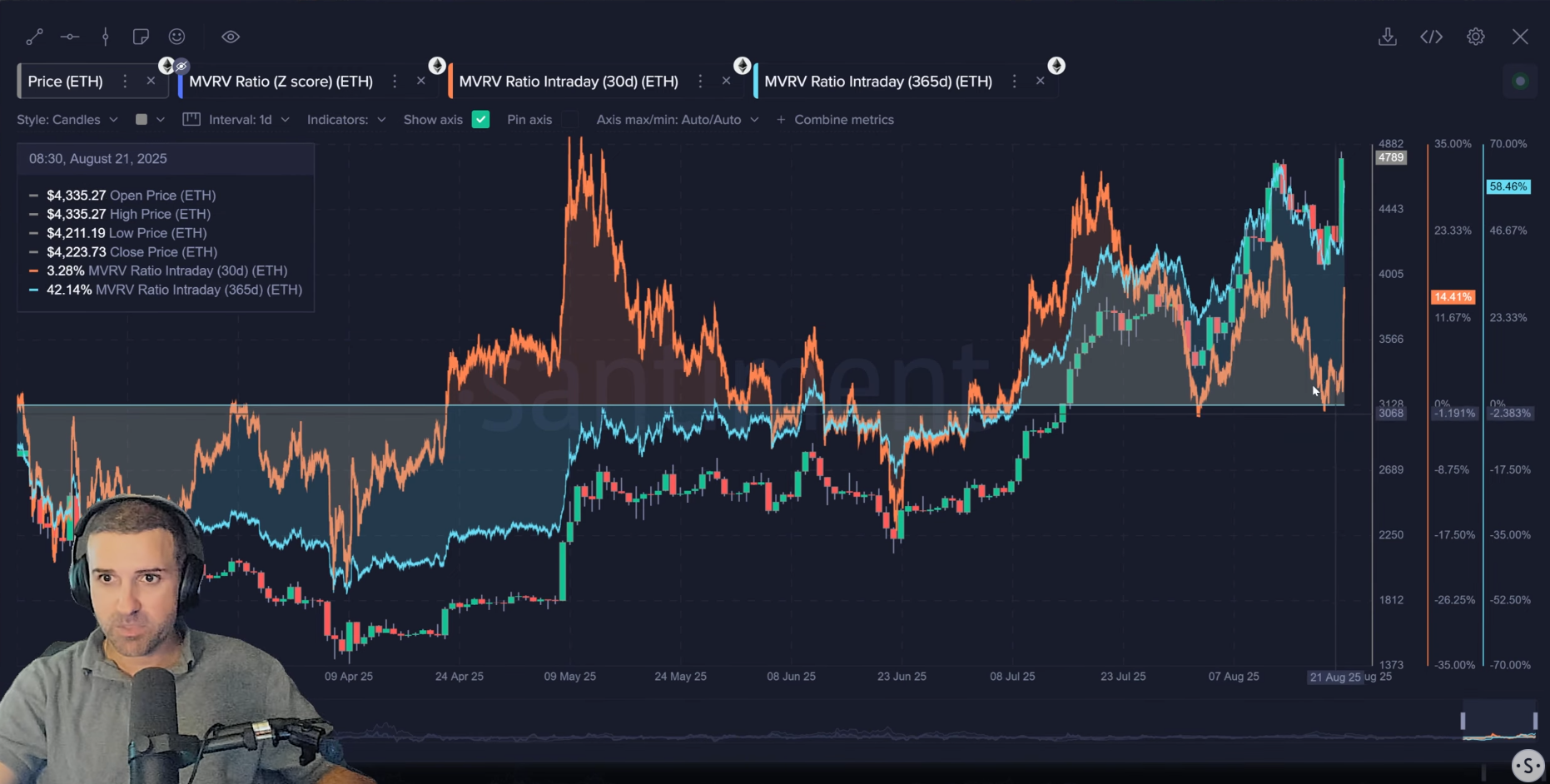

- Ethereum is negotiated 2.2% below the ATH with a health warning via high MVRV ratios

- MVRV from 30 days to 15% and long -term to 58.5% signal signal profit risk

- Haussiers signs include the drop in supply in exchange and the increase in network activity

The second largest cryptocurrency won 32% in the last 30 days and has climbed more than 5% last week. Ethereum (Ethn) reached $ 4,834 in recent negotiation sessions.

The blockchain analysis company warns that evaluation measures enter a risky territory which could cause profitable activity.

Why Ethereum Price reaches a new summit of all time

Ethereum increased by more than 40% in 2025, outperforming Bitcoin, after recovering $ 4,000 in early August and exceeded $ 4,500 a few days later.

The rally is motivated by strong entrances to the ETHEREUM SPOT ETHERE – approved by the Securities and Exchange Commission of the United States in July 2024 and now holding more than $ 20 billion, led by Blackrock’s ETHA – as well as the rise of the treasures of digital assets (DAT) centered on ether.

ETHEREUM ETHEREUM also saw renewed entries, adding $ 287 million on Thursday and more on Friday, bringing total FNB assets to $ 30.54 billion. Meanwhile, Ethereum ecosystem shows a strong activity, the supply of stable provides 10% to 147 billion dollars and total transactions going to $ 880 billion, which increases project income.

Ethereum’s price also increases due to increasing expectations that the Federal Reserve could reduce interest rates in September, following lower than expected employment data and a higher unemployment rate.

A FED endowed would probably move investments in low -risk bonds to risky assets such as crypto.

Ethereum’s danger zone hits – the signals on the chain keep the bulls jump

Santiment analysis indicates the signals concerning the market value ratio of Ethereum / value carried out (MVRV). The short -term 30 -day MVRV approaches 15%, a level that the analytical company identifies as an “danger zone” where altcoins are frequently confronted with withdrawals.

The long -term MVRV is currently 58.5%. This high reading suggests that current holders are seated on unrealized substantial benefits. This increases the probability of selling pressure if the eTH lost by resistance levels.

MVRV ratios measure the difference between market capitalization and the ceiling carried out. When these ratios reach extreme levels, they often precede price corrections because investors benefit from benefits.

The 15% threshold has historically scored turning points for Ethereum, past cases coinciding with price reductions that vary from 10% to 25%.

Bull signals on the chain thwart the evaluation warning

Other chain metrics paint a more optimistic image for the long -term prospects of Ethereum. The average age invested in dollars drops sharply. This shows that the previously sleeping coins come back into active traffic.

The profits made from the network are also in doping, which shows an increased negotiation activity through the network. This measures the total benefit made by all the parts moved to the chain, providing an overview of the feeling of the market.

More bullish, the ETH offer maintained on the scholarships continues to decrease. This trend suggests that investors prefer the storage of the self-leather to maintain tokens on trading platforms.

The metric of the exchange offer has been downwards for months, investors moving the assets to cold storage wallets. This behavior is often correlated with the assessment of prices because it reduces the offer easily available for trading.

Post Comment