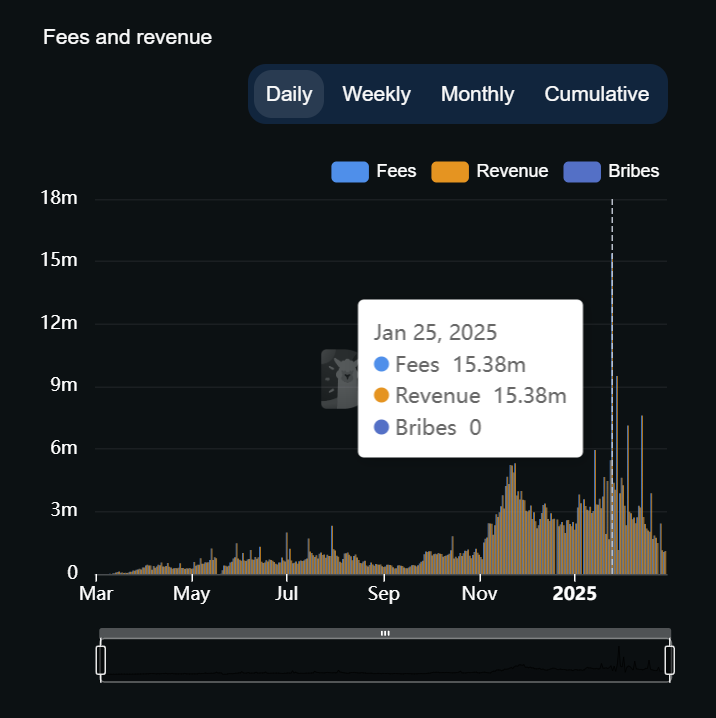

Pump.fun fee revenue is down 92% from January peak

Revenues from PUMP.Fun protocol fees fell 92%, as activity on the platform was triggered following recent controversies.

Revenues from PUMP.Fun protocol fees decreased by 92%, falling from its peak by $ 15.38 million on January 25 to only $ 1.1 million today, according to Parade. This sharp drop in income is broader activity on Pump.fun and Solana (GROUND) The network has slowed down following recent events in the same currency space, notably the balance of the balance involving Argentinian president Javier Milei.

Apart from the costs of the costs, the tokens launch on Pump have also experienced a solid decline, from more than 70,000 Dunes. This drop is part of the wider trend observed this year, with the same corner marketcap lose in value.

According to the subsector Binance analysis. This wave was largely fueled by the popularity of Pump.fun, which saw more than 5.7 million new projects launched and generated more than $ 400 million in income throughout the year.

However, 2025 led to a change of feeling. Initially, the pieces even were considered to be “fair launch” opportunities, where retail investors had the same chance of taking advantage of the venture capital and funds. However, this perception has now been questioned. THE Launch of the Milei partFor example, has seen its valuation reach $ 1 billion and quickly reach $ 4 billion, revealing the scam and manipulative nature of the coin sector.

Pump.fun himself was recently the victim of fraud. On February 26, the pump account.fun x was compromise And used to promote a fake pump of governance token with other fraudulent pieces.

Post Comment