Bitcoin’s bull cycle is over, prices could fall lower due to whale action

Bitcoin has reached the end of its bull cycle and the market will be faced with lower or lateral price movements in the coming months, according to the CEO of Cryptoant Ki Young Ju.

In a recent job,, Cryptocurrency CEO Ki Young Ju predicts that during the following six to 12 months, Bitcoin (BTC) will see “the lower or lateral price action”. To support his conclusion, Ju shared a historical table, which highlights the cyclical signals of the profit index and BTC losses dating from 2014 to 2024.

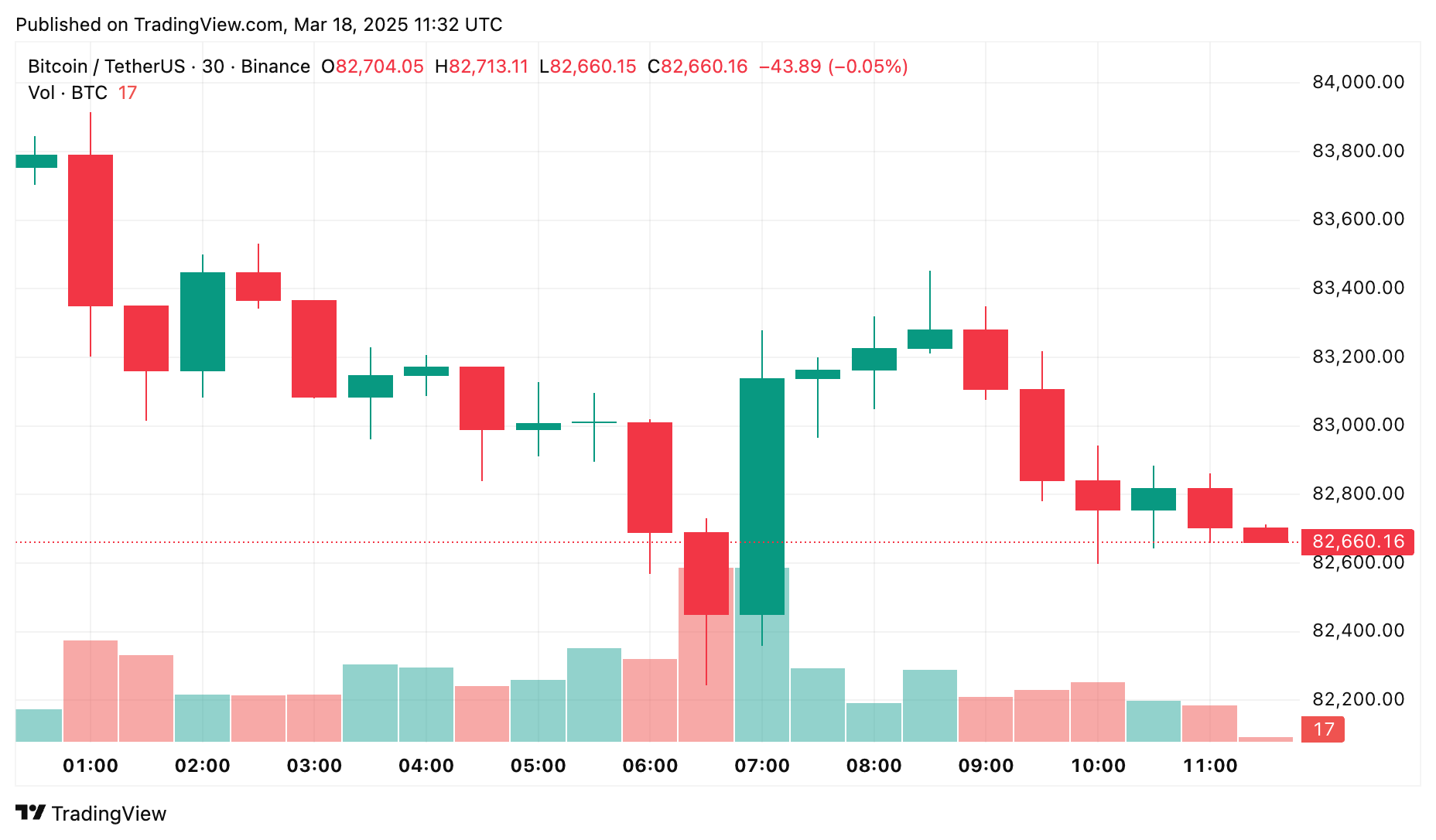

At the time of the press, Bitcoin dropped by almost 0.8% in the last 24 hours of negotiation. The largest cryptocurrency by market capitalization is currently negotiated at $ 82,752, according to data of crypto.News. During the last month, Bitcoin was down, falling by 15%.

Huge whales selling bitcoin in large portions

In a separate article, Ju shared his analysis which applied the main analysis method to the metrics on the chain such as the market value report on the market value, the production ratio of production spent and took into account the profit / net loss not achieved. He used it to calculate a mobile average at 365 days to identify the turns in the one -year mobile average trend.

“Each metric in chain signals a bear market. With a fresh liquidity, new whales sell bitcoin at lower prices,” said Ju in his position.

Shortly after JU published his analysis, a whale was detected on the chain closing its short -term Bitcoin position and made a profit of $ 4.06 million in just three days of negotiation. The whale is famous for opening an Ethereum (Ethn) Long position with a 50x lever effect, worth around 200 million dollars on hyperliquidal on March 12, which led the platform to undergo a loss of $ 4 million.

According to data From Spotonchain, the whale was found depositing approximately $ 17.82 million USD (USDC) to the hyperliquid on the sidelines in the last three days to short-circuit the BTC with a 40x lever effect. Recently, the address closed all its positions and withdrew around 21.88 million USDC in its portfolio.

After closing all its positions, the whale spent 6.11 million USDC to buy 3,202 ETH. Not only that, the merchant also sold 3.28 million USDC in exchange for 1,040 Paxg (Paxg) Damn.

In recent days, traders have seen an influx of whales opening up long and short positions with a high lever effect on the hyperliquid. On March 17, an anonymous whale was “driven” by crypto traders for departure A short position for around $ 450 million Bitcoin 40x.

Post Comment