MOVE eyes 65% rally as $32m buyback plan sparks whale accumulation

The move climbed to a 2 month summit while it separated from a malicious market, which sparked a renewed interest among the whales.

According to Crypto.News data, movement (MOVE) increased by 32% for an intra-day summit of $ 0.594 on March 26 afternoon, while its market capitalization amounted to $ 1.36 billion. Its daily trading volume also increased by 7 times during the period, reaching around $ 829 million.

Most of today’s earnings came after the movement of the movement network announcement He had recovered around $ 38 million in USDT from a now prohibited market market that operated on Binance.

The entity was initially brought to provide liquidity to move to the platform by taking purchase and sales orders to help stabilize the price and support healthy trade. However, the market market has become malicious and dumped 66 million movement tokens shortly after the token Listing on Binance while placing almost no purchase order.

Binance reported this behavior as “market irregularities”, froze the profits of the market manufacturer and removed them from his platform.

The Foundation Movement, which has broken the links with the company, engaged the total of $ 38 million to a three -month buyout program called Movement Strategic Reserve. Basically, they will buy a free market move to facilitate the sale of pressure and resume more liquidity in the ecosystem.

Buyout news launched a wave of Empowerment of whales.

On March 24, portfolios holding between 100 and 1 billion moves had around 553 million tokens. To date, this number has climbed up to 953 million, which means that whales have increased by around 400 million in the last 48 hours. At the current price, this represents more than $ 185 million in tokens.

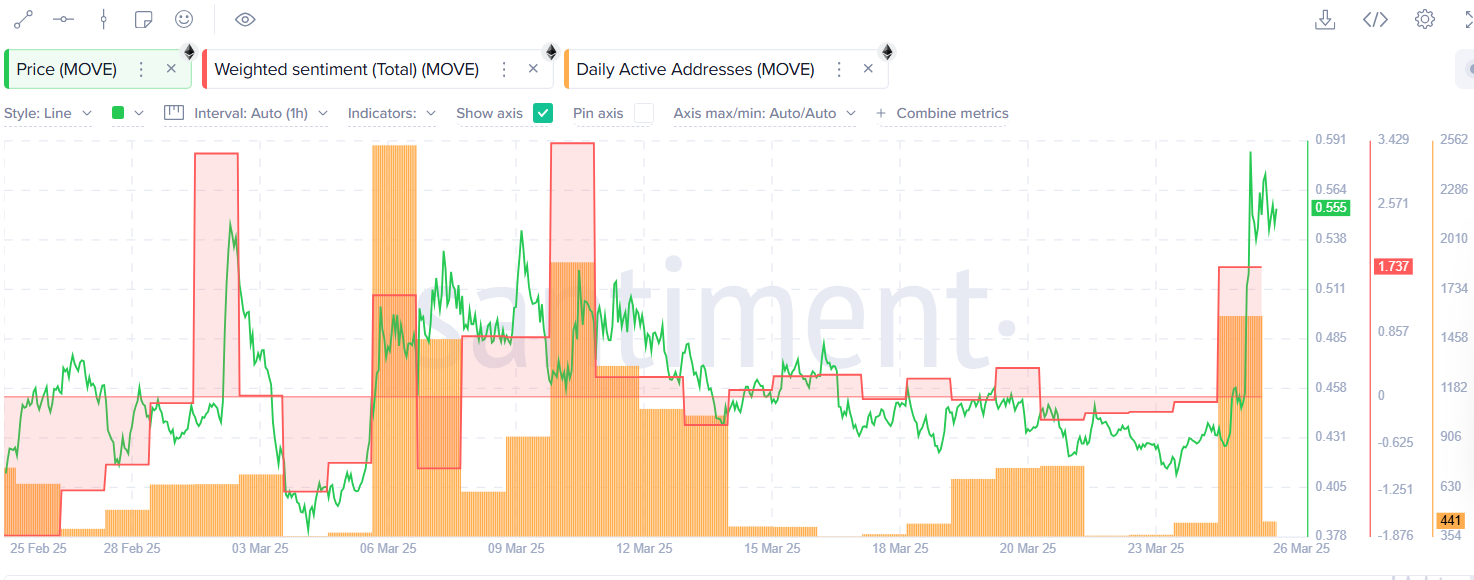

Channel metrics also seem strong. Daily active addresses increased by 265%, and social feeling was implemented during the last day.

Travel price analysis

On the price table at 1 day / USDT, MOVE is out of a drop -down corner model of several months, which is generally a bullish inversion signal and could signify a longer rally in front.

The MacD and Super oscillators lines are both pointing, which confirms that the momentum is in favor of the bulls and points more upwards in the short term.

In addition, the monetary flow index amounted to 65 years, showing that the purchase of the pressure resumes, but there is still room for more before it reaches the exaggerated territory.

Given these positive signs, the displacement could come together to its psychological resistance at $ 0.90, 65% above current levels. It also acted as a key resistance level for Altcoin. A break above this brand could push it to target its annual summit of $ 1.12.

However, if the displacement breaks below the lower trend line of the corner, the configuration can be invalidated. In this scenario, the value of the Altcoin could increase to $ 0.37.

Disclosure: This article does not represent investment advice. The content and equipment presented on this page are only for educational purposes.

Post Comment