Stablecoin exchange balances hit 3-month low

The Stablecoin sales, a key figure for the feeling of investors, have dropped to their lowest level for months, while Bitcoin has plunged at its lowest point this year.

Cryptographic markets show growing signs of weakening the appetite of trader. On Monday, April 7, Stablecoin balances on trade fell to a three -month hollow. According to the Crypto Nansen analysis company, it is the lowest that the figure has been since January. In addition, the entrants and outgoing crypto exchange flows decreased in April.

Change coincided with Bitcoin (B) Direct below $ 75,000, marking the lowest levels observed since early November. The current uncertainty surrounding the effects of Donald Trump’s prices continues to weigh heavily on the cryptography and scholarship markets.

In this context, the data probably indicates a reduction in investors’ appetite for trading, as risk assets become less attractive. The lower stable sales on the scholarships suggest the drop in liquidity in the cryptographic markets, which could put pressure on prices while traders expect more favorable entry points.

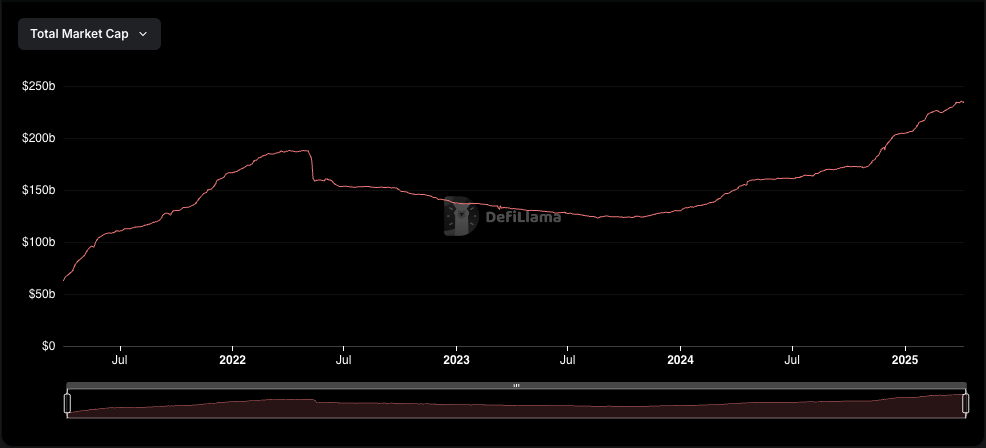

The market capitalization of stablescoin continues to grow

Despite a low exchange flow, the total market capitalization of the stable has placeHe has increased In 2025. The figure increased from $ 203 billion on January 1 to 234 billion dollars currently. This growth is probably driven by traders converting altcoins into more stable assets, a common trend during periods of stress on the market.

Stablecoins play an essential role in the cryptography ecosystem, both as a payment method and as a risk management tool. They tend to be much less volatile than other digital assets, which makes them attractive during uncertain periods. This role could still develop if new regulations come into force.

Last week, April 2, the Chamber’s Financial Services Committee approved the Stable act. The law aims to strengthen transparency and consumer protection for stablecoins, forcing companies to disclose their reserves.

Post Comment