XRP correction may be ending as bulls watch $2 breakout zone

According to analysts, XRP is negotiated near a key accumulation zone, which could strengthen its case for a rally upwards.

In an April 8 x jobAnalyst Dom stressed that XRP now fills a “liquidity vacuum”, essentially correcting an ineffectiveness of the action of the late November prices. This puts the assets in a tight range between about $ 1.50 and $ 2.00.

The analyst noted that the $ 2 brand serves as a level of critical resistance and key accumulation zone. A clear break above reports a change in potential structure which could officially put an end to the current decrease trend.

At the time of the press, XRP (Xrp) fell by 3.3% in the last 24 hours, exchanging hands at $ 1.80, while its market capitalization was seated at more than $ 104 billion. Its daily trading volume also fell 42% to $ 6.3 billion.

Haussiers catalysts for XRP

Nevertheless, a certain number of positive developments linked to XRP lead many traders to believe that XRP could prepare for a bull rally.

First of all, the Launch of the ETF XRP with Téucrium lever effect (XXRP) marks the first ETF linked to XRP in the United States, offering double daily yields on XRP. This establishes a major precedent for institutional and legitimate participation in undeling investment products in traditional markets.

This step arrives in the heels of the dry drop his call and settle The Ripple case with a penalty of $ 50 million, effectively eliminating long -standing regulatory uncertainty around XRP. Legal clarity has aroused a renewal of institutional interest, companies like Franklin Templeton, Bitwise and 21Shares now pursuing Spot XRP ETF.

Excitation also increases around the potential launch of an XRP ETF at the end of 2025. According to Polymarket dataThe approval ratings rose to 77%, going from a 72% drop recorded on April 7.

Second, Ripple has announcement The acquisition of the brokerage company Prime Hidden Road in an agreement of $ 1.25 billion, one of the most important in the history of the cryptographic industry. This decision extends the institutional imprint of Ripple by taking advantage of the established client network of Hidden Road, positioning Ripple as a more dominant actor in global finance.

Third, chain metrics support a bullish perspective.

Santiment data reveal regular accumulation by portfolios with 100,000 to 100 million XRP, generally considered to be intelligent money. This purchase activity during the DIP suggests a strong conviction among the largest investors, often considered as a precursor to the upward price movement.

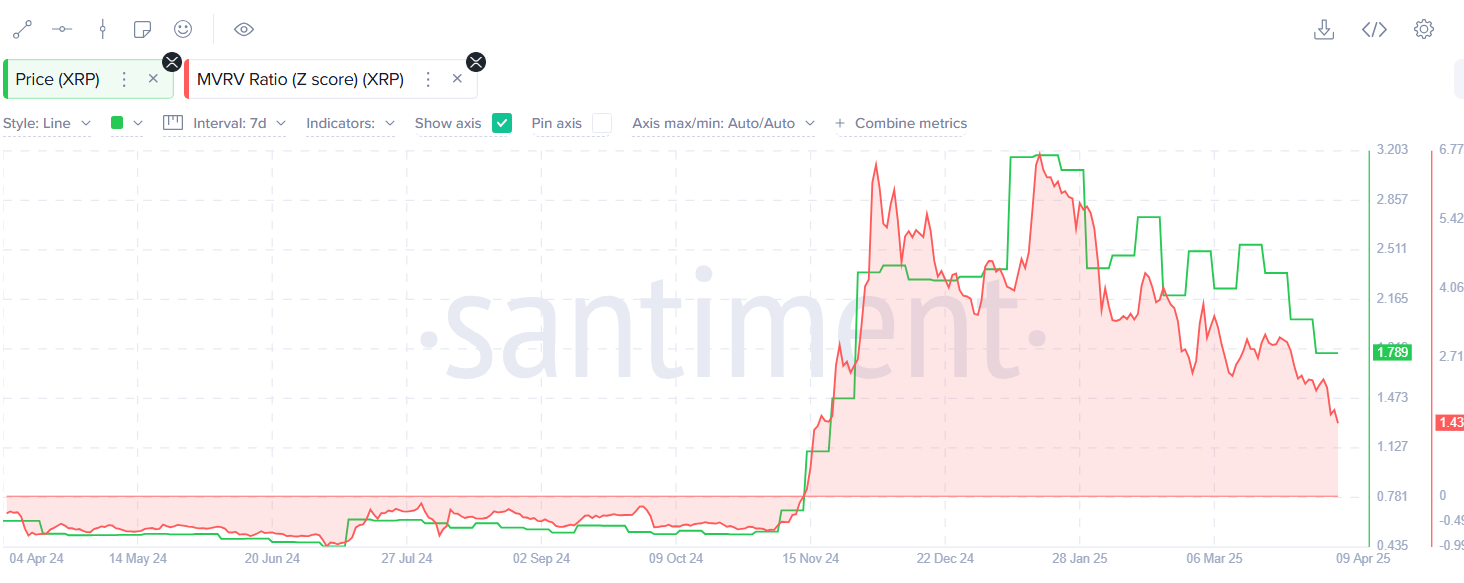

The XRP MVRV Z-SCORE also fell to 1.43, its lowest level since November of last year. This is notable because the last time it was low, XRP launched a bull race and finally reached its summit of $ 3.40.

A lower Z MVRV score generally means that the asset is undervalued compared to its historical average, which can be a sign that the market is close to a background and started for a rebound.

Meanwhile, its weighted funding rate has returned to green, indicating a feeling of investor improvement among XRP derivative traders, because more of them are now placed bullish bets after a period of caution.

According to Crypto.News analysts$ 2 is the most likely goal for XRP.

Over a longer period, Chartered Standard Experts have together An even higher price goal, projecting $ 5.5 as a realistic objective by the end of the year. Their forecasts come after the 580% XRP rally from November 2024 to January 2025, suggesting that there are room for 214% of new current levels.

XRP still in the correction phase

Howver, trader cheetan gurjar believes XRP is still in its vague 2 correction phase, based on the theory of Elliott waves, a popular trading method where the price moves in models of five waves when the market is trendy and three waves lowered when corrected.

Currently, Chetan thinks that XRP is in one of these “below” phases, Wave 2, which generally occurs before the next big movement. He considers this drop as a healthy retracement, with possible backgrounds around Fibonacci key levels: $ 1.48, $ 1.1453 and $ 0.88,856.

Chetan also has high long -term objectives: at least $ 8 to $ 12, with the possibility that XRP reaches up to $ 23 to $ 30 in the next major cycle. He notes, however, that a ventilation less than 0.3823 would invalidate his number of current waves.

Disclosure: This article does not represent investment advice. The content and equipment presented on this page are only for educational purposes.

Post Comment