Bitcoin sell-off puts mid-term holders under pressure: Glassnode

Bitcoin drop pressure has seen the sales dynamics pass more recent parts to older cohorts, the progressive capitulation occurring in the middle of a wider weakness of the market.

Metric platform and chain data information Glass knot said Bitcoin (BTC)) The downcoat drop pressure has seen the sales dynamics pass more recent parts to older cohorts, the progressive capitulation occurring in the middle of a broader weakness of the market.

An updated year, the BTC dropped by more than 17%, a drop by 9% last week. Broader prices and economic uncertainty have weighed heavily on risk assets, Including bitcoin.

With this performance, coins in the three to six months cohort have seen the share of losses made increase to more than 19%. It was only held about 0.8% on February 27 before bear market Feeling struck.

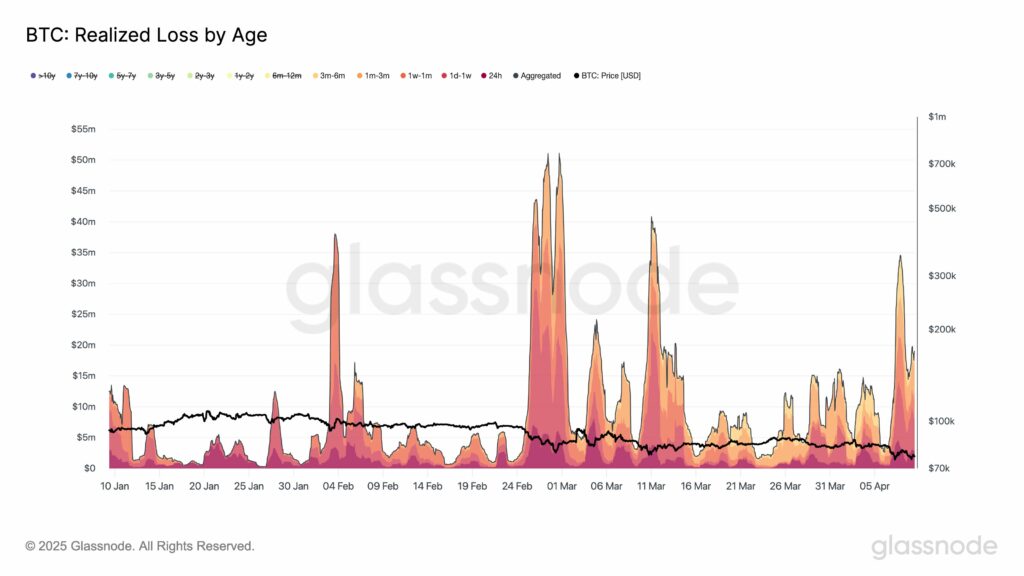

“In comparison with previous Bitcoin sales YTD, losses are now propagated to older parts – in particular in group 3M to 6 m, whose share of losses increased from 0.8% to 19.4% of the total losses since February 27,” posted Glassnode on X.

A graphic that the platform has shared shows that the loss made by the BTC by the age metric has greatly dpirié in April.

The younger pieces – during a week to one month and one month to three months, represented more than 50% of the total losses made at the end of February.

However, while the 3m to 6 m cohort then represented less than 1% of total losses, the trend has since reversed, this group now representing a much more important part.

This change has intensified when the price of the BTC decreased by more than $ 86,000 at the end of February. A support detection of less than $ 75,000 in March accelerated the passage to the capitulation for holders from 3m to 6 million. On March 11, the share of the losses of group 1m to 3 million fell at around 16.3%, while that of the 3m to 6 m cohort rose to 4.9%.

Despite total BTC losses at around $ 41 million, data on the Glassnod chain show that older cohorts are undergoing a “progressive enlargement of capitulation”. In early April, the cohorts 1W at 1 m and 3m at 6 m were each responsible for around 19% of the losses made.

“This marks a structural change in the realization of losses and indicates sustained pressure on mid-term holders,” noted the analysts.

Bitcoin is down 2% in the last 24 hours.

Post Comment