Bitcoin price could underperform stocks as ETF outflows continue

While Trump’s price break has supported the markets, traders are always reluctant to resume assets at risk.

Cryptographic markets are captured between cautious optimism and persistent uncertainty. While the price break has helped stabilize the markets, traders still hesitate to fully commit to risking assets, Bitfinex analysts in Crypto.news told. Consequently, Bitcoin (BTC) has exchanged laterally and ETF flows remain moderate.

According to Bitfinex analysts, 90 -day break from US President Donald Trump On prices is not a long -term solution. Instead, it represents a temporary stay that does not solve wider commercial uncertainty. This has maintained suspicious investors of risky assets like Bitcoin, which suggests that feeling remains cautious.

“The Trump’s 90 -day pricing break is not a resolution, only a delay. Investors understand that tariff threats remain on the table, and as such, it is unlikely that positioning moves aggressively to risk

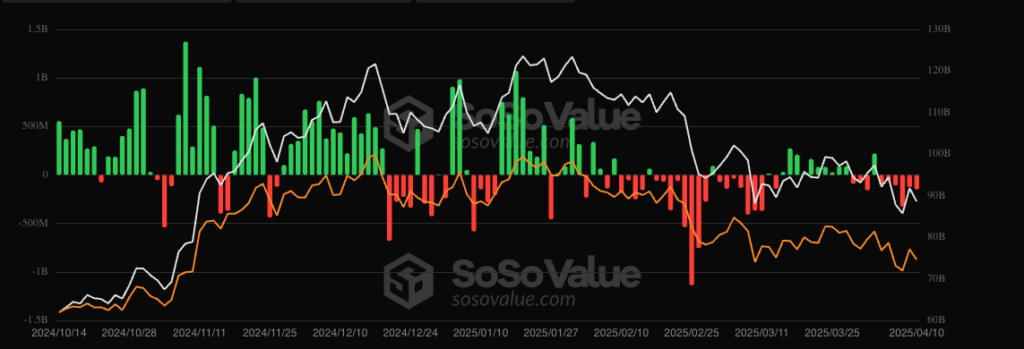

At the same time, Bitcoin ETF Flows Continue to disappoint. As of April 10, the ETFs recorded their sixth consecutive day of negative flows, with daily outings totaling $ 149 million. The biggest outing of a day occurred on April 8, when $ 326 million left the FNB Bitcoin.

Bitcoin could underform actions: Bitfinex analysts

In the current environment, cryptographic assets are likely to underperform actions until a new catalyst emerges, according to Bitfinex. Possible drivers could include a dominant pivot of the American federal reserve or a wave of liquidity renewed in the cryptographic markets.

“Bitcoin can also benefit from a slight reduction in macro pressure, but the market will probably wait for more concrete signals – such as a change in nourished tone or improve liquidity conditions – before returning aggressively in the crypto. We believe that crypto could underline the actions in relative terms until it happens. ”

Potential relief can occur due to Trump’s pressure on the Fed chair, Jerome Powell, Reduce interest rates. However, due to the rise in inflation fears, the Fed will probably continue in its current course, unless a change in leadership takes place. In particular, a recent decision of the Supreme Court Activated Trump To temporarily oust independent agencies officials, some suggest that Powell could be the next one.

Post Comment