Investor funding in web3 games drops 71% amid macro headwinds: DappRadar

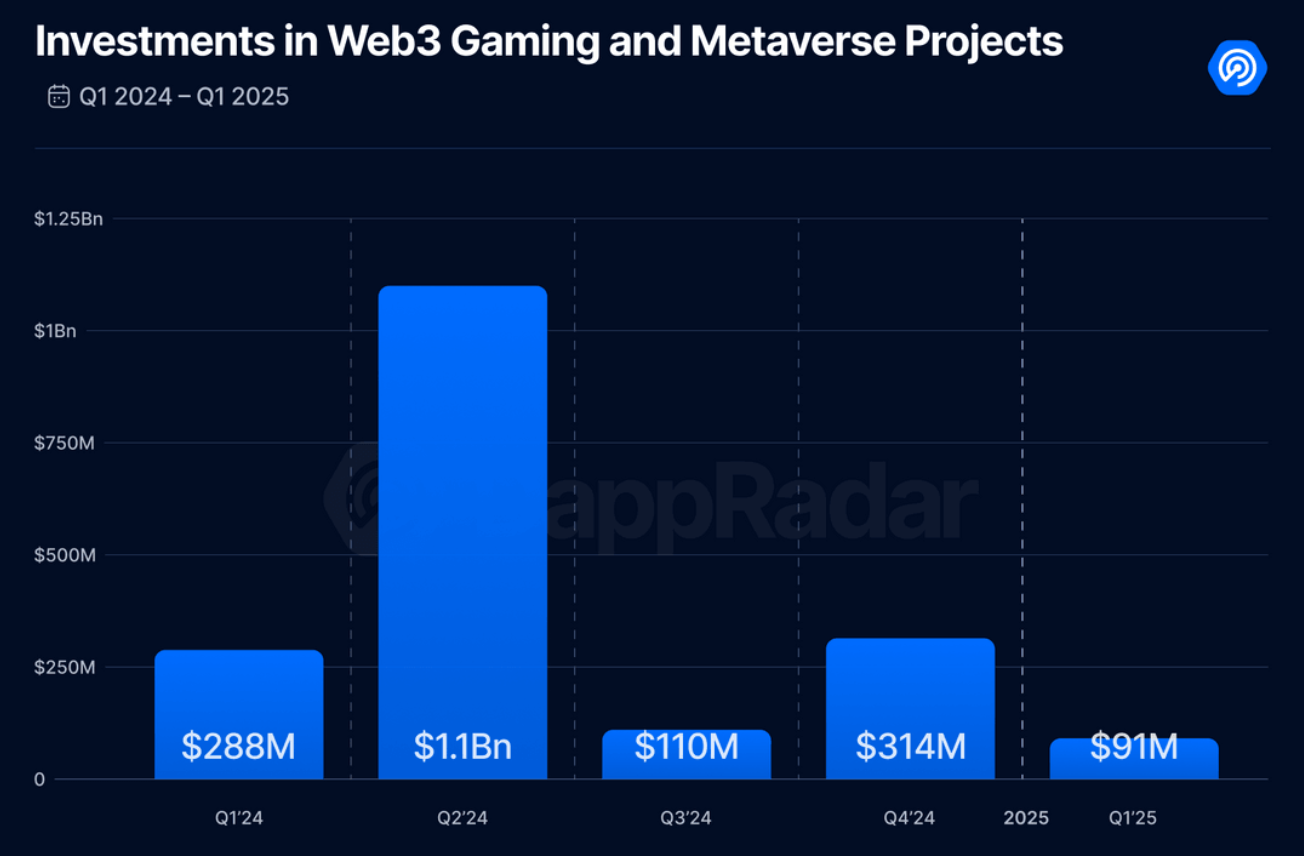

The financing of blockchain games plunged in the first quarter, total investments decreasing by 71% quarterly, according to data.

Web3 Gaming took a hit in the first quarter when the world markets faced the pressure of trade wars and increasing geopolitical tensions. Data analysis platform DAPPRADAR analysis platform shows These web3 gaming investments dropped from 71% quarter to $ 91 million, although the number of transactions increased by 35%.

Blockchain games recorded 5.8 million unique active portfolios per day in the first quarter, down 6% compared to the previous quarter, according to data. Despite the drop, Sara Gherghelas, analyst of Dappradar’s blockchain, says that OPBNB remained “firmly in mind like the most used game blockchain this quarter”.

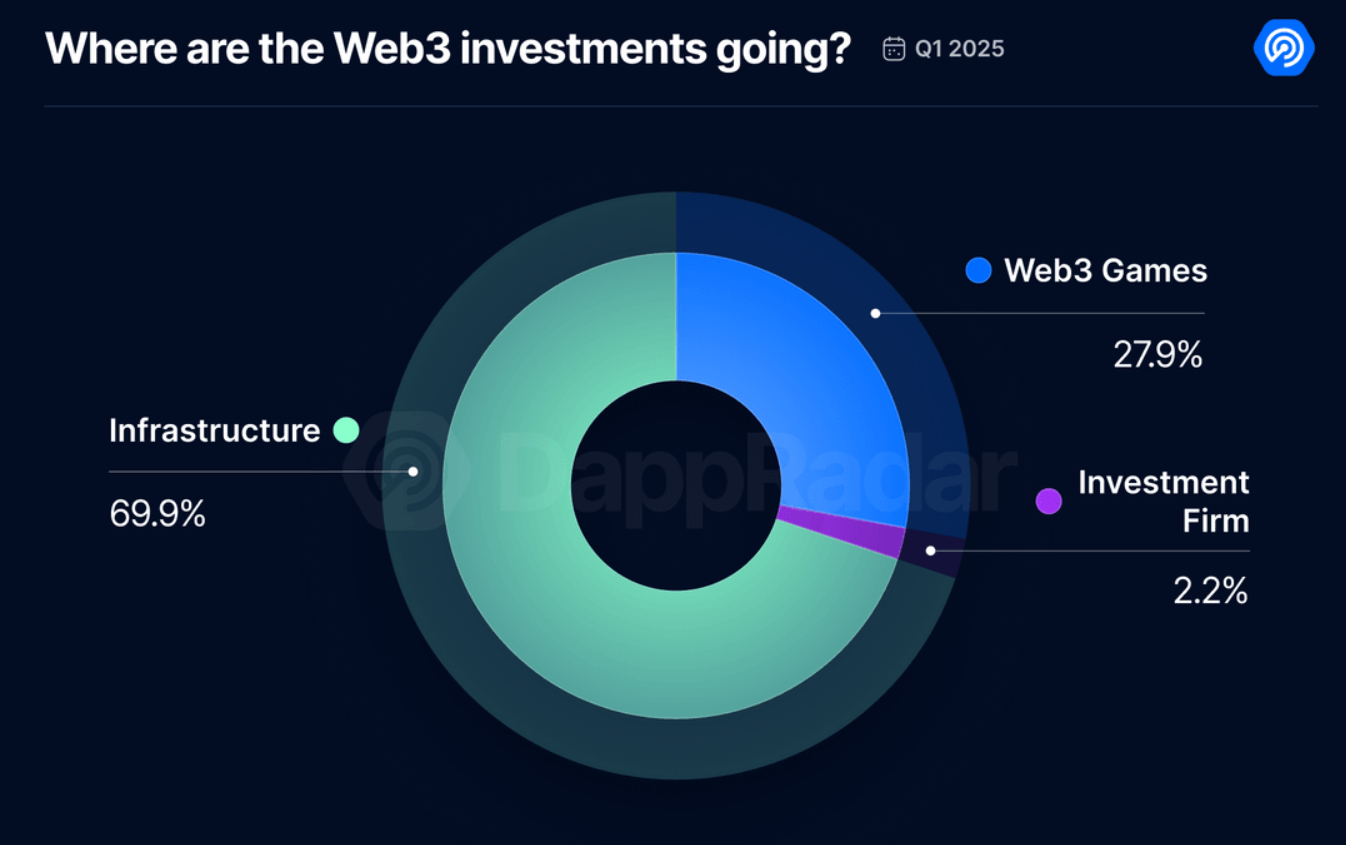

It is not only the game investments that have cooled – the metailed activity has slowed down too, with Nft The negotiation volume fell by 28%, said Gherghelas. Despite this, infrastructure remains an absolute priority for investors. The key rounds of this quarter included $ 20 million for Marblex, $ 13.5 million for Beamable and 10 million dollars for the game company, all focused on construction tools and backends for a scalable game.

Dappradar’s analyst notes that the majority of the financing of this quarter “has been devoted to infrastructure -focused projects, which strengthens a long -standing truth in web games: a strong infrastructure is essential for progressive and high quality playing experiences.”

And while overall activity and capital entries “placed due to broader winds of the market”, Gherghelas says that “increased number of agreements, continuous development of infrastructure and coherent performance of the best games” always demonstrate signs of a “resilient and evolutionary ecosystem”.

Like crypto.News reported Earlier, the wider market in the NFT did not behave much better in 2024. The volume of negotiation fell at $ 13.7 billion, against 16.8 billion dollars in 2023 – the lowest since 2020, while commercial activity decreased by 19%, and the total of NFT sales dropped to 49.8 million more than 60 million per year earlier.

Post Comment