Quinn Thompson raises red flags on ONDO amid Mantra token fallout

In the wake of the mantra scandal, Quinn Thompson, the founder and investment director of Lekker Capital, once again raised red flags on another Rwa Ondo Finance project.

On April 14, Quinn Thompson went to X to issue his renewal warning concerning Ondo Finance (Ondo) in the light of the recent Mantra debacle,, declaring “In the light of the recent Mantra $ OM token scam, probably prudent to recirculate this thread on $ Ondo in case he saves at least one person in the possible financial ruin.”

In the post, Thompson surface His previous thread of March 18, where he asked the chain investigators to confirm whether the total value of Ondo Finance locked is artificially inflated by the team which sells tokens and redirecting the product in the protocol to create the illusion of the adoption of organic users.

“Can one of the chain investigators confirm for me if it is true that the majority of Ondo TVL … comes from the sale by the team of Ondo tokens with the profits that have been reinforced in the protocol to identify the appearance of organic growth?” He wrote.

To support his statements, Thompson surface His article in October 2024, where he criticized the fully diluted evaluation of $ 7 billion in the project despite the generation of income and product supply (USDY and OUG) which are only “packaging on BlackRock Subject. “”

He also underlined the 0.15% socket rate of the company – which had been lifted until 2025, which means that the protocol did not earn any income despite its considerable TV. He argued that once the costs have come into play, users will probably move their funds to Buidl because it is safer, cheaper and has better yields. Even if Ondo begins to charge the costs, he would only gain $ 975,000 per year. “This exceeds an FDV multiple / income 7,000x on an almost zero margin company without pits and increasing competition,” he added.

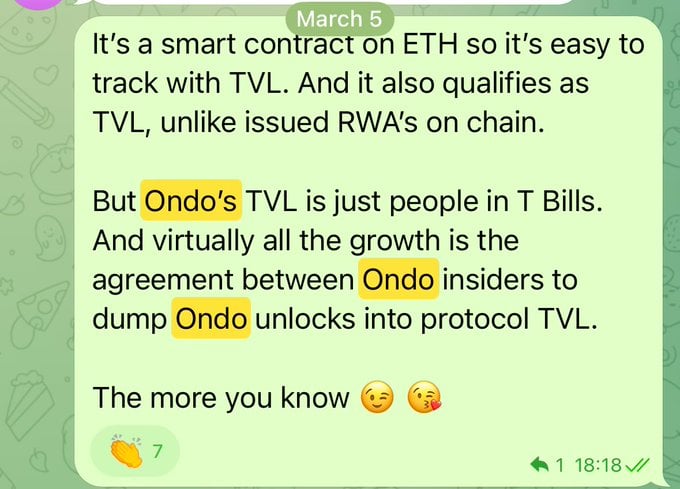

In response, a @timibot user commented“I thought it was on the secret of the Ouignée”, endearing a screenshot of what seems to be a message broadcast from a telegram group. The message describes the alleged mechanisms behind Ondo inflated TVL.

This suggests that, although the TVL funds are real, Metric TVL of Ondo Finance is misleading because a large part of the capital of the Ondo protocol is not supplied by DEFI, but is rather parked in tokenized American cash tickets, which are traditional low -risk financial instruments.

To bind any together, Ondo Finance can use the artificial inflation of TVL by selling their own Ondo, then taking this money and putting it back in their own protocol. Funds invested in T TVs are also part of the reported TVL, but they are not really used for Challenge Activities such as loan, loan or trading. These two tactics create a misleading image of the real adoption of the protocol.

Post Comment