U.S. Treasury issuance is a key macro area to watch

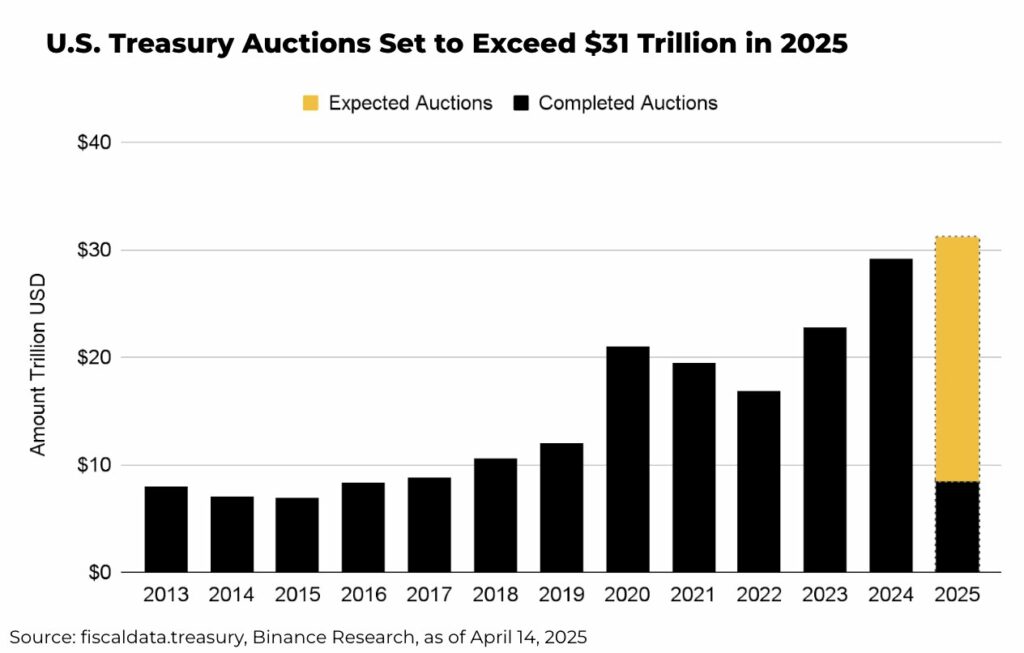

Binance says that the offer of the US Treasury will reach a record of 31 billions of dollars in 2025, a scenario that could have an impact on the macro environment and cryptocurrencies.

According to research in binance report On April 18, the issue of the US Treasury was expected to reach a total of 31 billions of dollars in 2025. This increase in the bonds of the Treasury will see the offer represent approximately 109% of the gross domestic product and 144% of the money mass of the M2.

This indicates an imminent financing pressure – including the refinancing of auctions – investors may want to pay particular attention to what is happening. Ideally, changes in M2 tend to have significant implications actionsObligations and other market segments such as crypto.

Binance research analysts note that foreign demand will be a key variable in this scenario of emission of massive debts.

From the expected offer, around a third will belong to foreign holders.

If the appetite for the American debt falls, or there is “an outright sale, driven by geopolitics or the rebalancing of wallet”, a balloon of funding costs will follow. The high yields will go above.

“Even if demand is stable, the magnitude of the issue is a structural challenge. A recent relief of risk assets – linked to optimism around commercial negotiations – has little compensated for the continuous pressure that this massive supply pipeline exerts interest rates through 2025,” noted Binance Research.

Stocks and crypto, including bitcoin (BTC), have undergone significant drop pressure in recent weeks. Price added to nervousness, the federal reserve not coming to the party with a drop in rate. President Donald Trump even threatened to dismiss the president of the Fed, Jerome Powell.

Analysts claim that the persistent upward pressure in the middle of an increase in the supply of the treasury has the potential to have an impact on risk assets. Nevertheless, a scenario where the government turns to the monetization of debt, with the monetary printer going “BRRRR”, would be optimistic for risk assets.

In this case, investors who seek to cover themselves against the discharge of currencies will flock to Bitcoin and other “hard active ingredients”.

Post Comment