Bitcoin shows bullish signs, but low volume raises caution flags

Bitcoin has recently flashed up certain bruising indicators, but a small volume suggests that large traders are still cautious.

Bitcoin finally shows bull signs. On Thursday, April 18, Scott Melker, known as the Wolf of all the streets to his many followers, stressed that Bitcoin stressed that Bitcoin (BTC) Closed above the 50-day simple mobile average with a solid candle. Although the price is corrected at $ 84,349, it is still higher than SMA level of $ 84,202.

This action has not occurred since February 3, indicating a potential positive change in the momentum. However, other indicators raise doubts. On the one hand, while Bitcoin is negotiated above the SMA level of 50 days, it is still lower than the exponential mobile average of 50 days, which is $ 85,328.

Low volumes mean bad news for Bitcoin

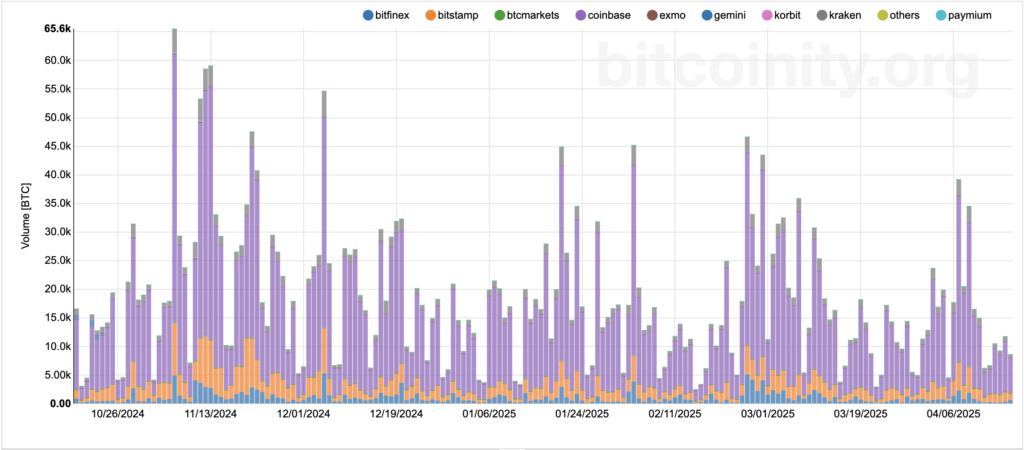

The token crossed this level several times during last week, but could not support the momentum. At the same time, Melker stresses that the low volume of trading suggests that buyers still hesitate to reach the market.

For example, the volume of negotiations on the main scholarships amounted to around 8,000 BTC on April 17, considerably decreasing compared to last week levels. On April 9, for example, the commercial volume on the main scholarships was around 26,000 BTC.

This suggests that investors are likely to expect positive macro news, which are missing in recent weeks. In particular, the current trade war with the main American partners raises fears of a potential economic recession. At the same time, the federal reserve is slow to add the supportFearing that American prices, especially on China, gave birth to inner inflation.

In all cases, Bitcoin will face resistance at $ 85,000, which corresponds to a long -term descending channel forming from its top of all time in January. And if the volumes continue to drop, the asset may fall on the chain’s midline at around $ 75,000.

Post Comment