Gold hits new ATH at $3,390, is Bitcoin close behind?

Gold increases to more than $ 3,390 on April 21, while more and more investors flock to assets with packages in the middle of economic uncertainty. A gold boost could point out a similar scheme in crypto, in particular bitcoin.

According to the last data of the commercial economy, gold has reached a new summit of all time in the middle of global economic volatility. On April 21, Gold increased by 2%, reaching the threshold of $ 3,390 and reaching $ 3,395 around 7:30 am UTC. Analysts predict that the increase in performance could be due to the increase in global trade tensions and following the lowest in the US dollar.

Just a week ago, president Donald Trump ordered an investigation into new potential price on critical mineral imports. This marks a significant escalation in the commercial dispute between the WE and other countries, especially China. In addition, investors are starting to lose confidence in traditional fiduciary currencies while the US dollar has dropped to a three -year hollow.

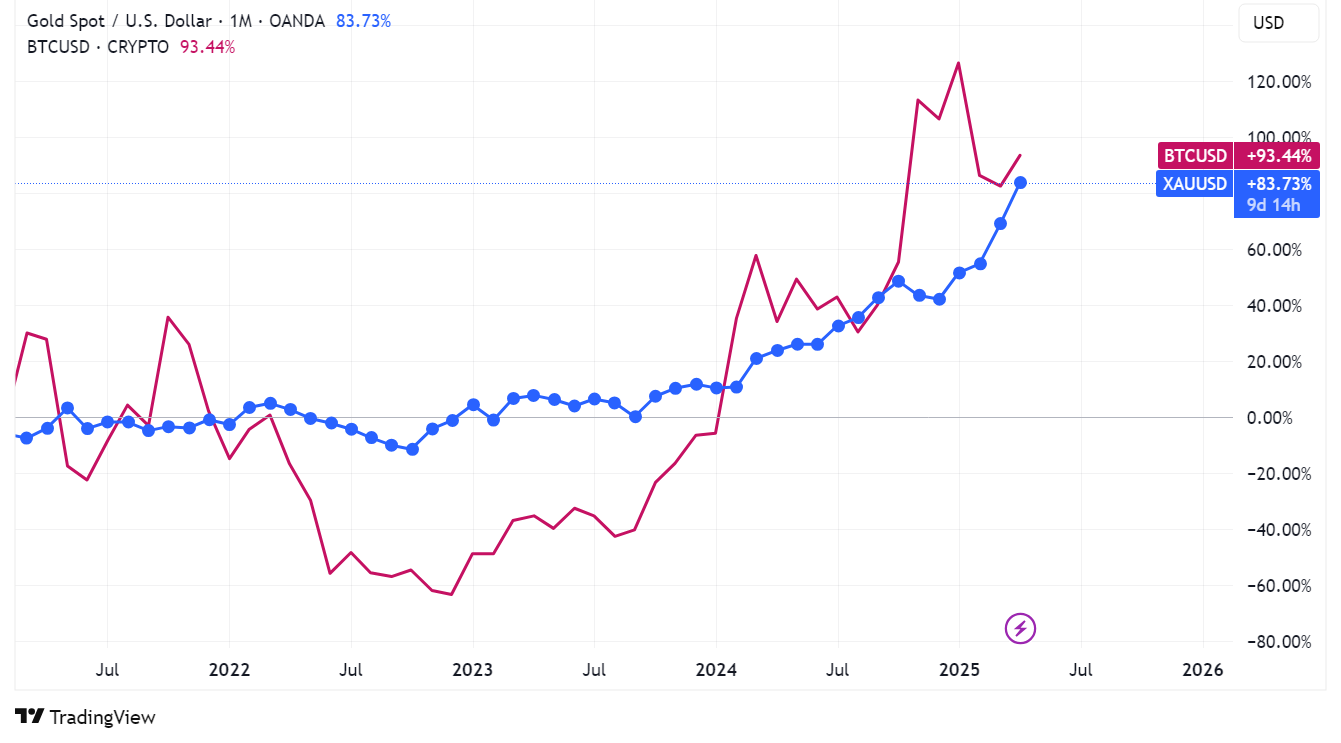

On the other hand, the meteoric rise of Gold could point out the beginnings of a bullish rally for the cryptography market. The merchants noted the price of gold and bitcoin (BTC) Often go hand in hand, since the two are “safe” assets.

In fact, the same day, Bitcoin reached a new monthly summit of $ 87,570. At the time of the press, BTC increased by more than 3.2% in the last 24 hours of negotiation. It is currently negotiated at $ 87,538. The last time BTC reached more than $ 87,400 was back on March 28, before he had a crisis in early April.

What is the historical relationship between gold and crypto?

Bitcoin has often been compared to “digital gold” by traders and investors. President of the Federal Reserve Jerome Powell said This bitcoin was a competitor for gold because of how the two assets are used as a value reserve rather than as a payment option.

Likewise, Founder and CEO of Ark Investment Management, Cathie Wood foreseen The market capitalization of 2 billions of dollars of Bitcoin could one day exceed $ 15 billions of gold over time. Although he has been there for longer, he obviously took gold longer to reach 2 dollars, which only took Bitcoin only 15 years.

“At $ 2,700, gold is a market of 15 dollars, against Bitcoin at only 2 dollars. Even after piercing $ 100,000, Bitcoin is still in the first round,” said Wood.

Historically, positive golden movements in gold are often followed by an increase in bitcoin prices shortly after. Aside from the fact that the two assets are considered “safe paradise” which protect investors against the volatility of traditional fiduciary currencies, the two also have finished supplies which must be extracted.

Despite these similarities, a bloomberg analysis have found that gold always has a much lower volatility rate compared to bitcoin; The annual volatility rate of Gold is approximately 10%to 20%, while Bitcoin often exceeds 50%. Although this may be the case, analysts also have note These macro-bitcoin trends tend to follow gold in a few months.

Post Comment