DOW Jones down 1000 points amid uncertainty over tariffs, Fed’s future

American actions take blows as ongoing fears on trade relations and attacks against the Fed weigh on the markets.

The current uncertainties on the trade war of President Donald Trump and the attacks on the Federal Reserve see investors abandon the US dollar and the actions. The Dow Jones fell 976.23 points or 2.49% at the end of the afternoon since the beginning of the afternoon, while the S&P 500 fell by 2.63% in the same period. The NASDAQ index focused on technology fell even more, down 2.97%.

At the same time, the US dollar index was as low as 97.92, going to his lowest level since 2022. Trump’s escalation of attacks against the president of the Fed, Jerome Powell, encourages some investors to wonder if the Fed can remain independent.

At the same time, Bitcoin (BTC) Reached a daily summit of $ 88,460, which suggests that some traders can see it as a safe refuge compared to a weakened dollar. Gold also experienced a solid performance, up 2.95% to $ 3,413 per ounce.

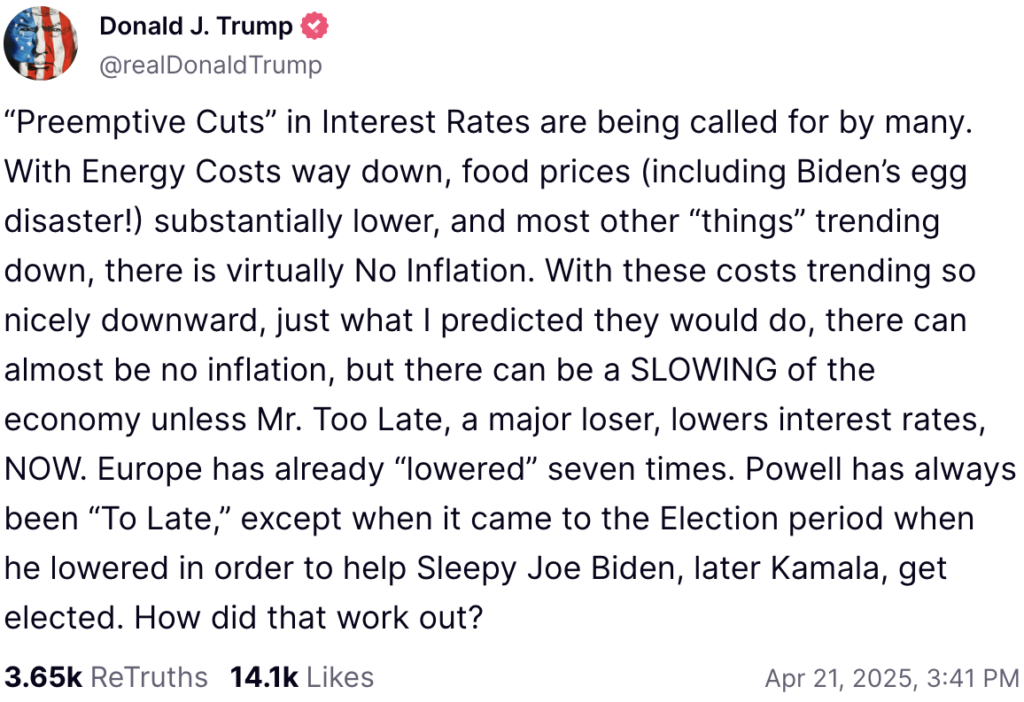

Trump for fed fleshs to reduce rates

In a Monday, April 21, after Truth Social, Trump qualified Powell as “Main loser” and “M. Too late ”, putting it pressure to reduce the most attractive rates to help the stock market in difficulty. Trump said that the drop in energy prices, which are partly due to recession fears, would help stamp any inflation that could result from a drop in rate.

Unlike Trump, Powell has repeatedly Skepticism shown on the potential effects of the softening of monetary policy. In a speech in March, the president of the Fed explained that the American economy is doing well, despite the wild fluctuations on the stock market. In particular, Powell has cited solid figures that suggest that the Fed has time to react.

Since its creation, the Federal Reserve has set monetary policy regardless of Washington guidelines, as are central banks in all developed countries. This independence is considered vital to guarantee the strength of the national currency, because it contributes to political pressures in favor of devaluation.

Post Comment