Grayscale plans ETF expansion — which tokens are next?

Grayscale accelerates its ETF expansion while the company is looking for new growth paths in a context of increasing competition in the Crypto ETF market.

Grayscale, a main asset management company specializing in cryptographic investment products, provides for an expansion of its ETF range. According to Fortune interview With CEO Peter Mintzberg, the company has already increased its monthly launches or regulatory documents to a product in 2024 to five per month in 2025.

The rise in power occurs while the company has trouble maintaining its advantage after having lost the advantage of the costs which once distinguished its basic GBTC product. Securities approval and Exchange Commission of the United States of Bitcoin Spot (BTC) ETF in January of last year – transferred by the own legal victory of Graycale – opened the door for low -cost offers of giants like Blackrock and Fidelity. While the GBTC still manages $ 16 billion in assets, its costs of 1.5% resulted in substantial outings while investors took place towards cheaper alternatives.

In response, Graycale introduced a “mini” GBTC ETF With competitive costs of 0.15%, which has so far raised $ 3.5 billion in assets. However, the narrowing margins prompted the company to rethink its business model. Now Peter Mintzberg, who take over As CEO in August 2024, try to position gray levels to compete not only on costs, but also through differentiated investment products to win back a market share.

The company has already started its ETF expansion plan by exceed Two new ETFs covered by Bitcoin on April 2 – BTCC (Grayscale Bitcoin Covered Call Etf) and BPI (Grayscale Bitcoin Premium ETF). The two funds use covered call strategies to generate a monthly income from the volatility of Bitcoin prices. The BTCC prioritizes the generation of income thanks to options on Graycale FNB Bitcoin FNB, while BPI aims to provide both income and potential by writing appeal options out of money.

In addition to covered calls, Mintzberg sees a strong income potential in Ethereum (Ethn) mark out. In February of last year, Grayscale applied to the dry to allow the implementation of Son ETF ETF and ETF ETF, Mini Trust, with the decision, with the decision delayed Until June 1.

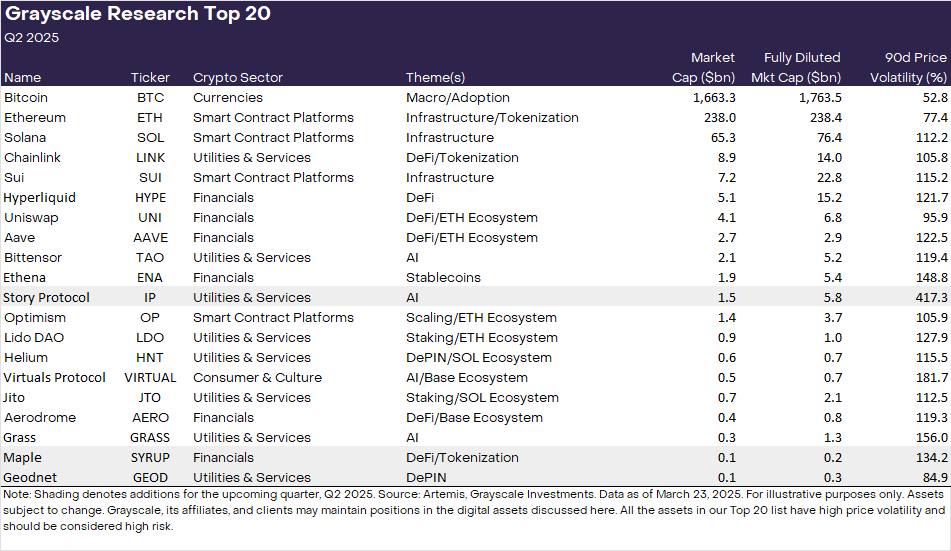

Grayscale also envisages FNBs which offer wide exposure to emerging cryptographic assets. Indices on the tokens could be included came with the recent release From the company’s “TOP 20” list of the company – a quarterly snapshot of high potential projects based on internal research.

This quarter, the accent is put on chips with real world utility in three main stories, namely Rwa tokenization, depin property and intellectual property, the out -of -competition choices (mapleSYRUP), Geodnet (Geod) and history protocol (IP).

Post Comment