XRP up 16% today, what is driving the gains?

XRP’s rally continued to show strength after surpassing $3 for the first time in three years.

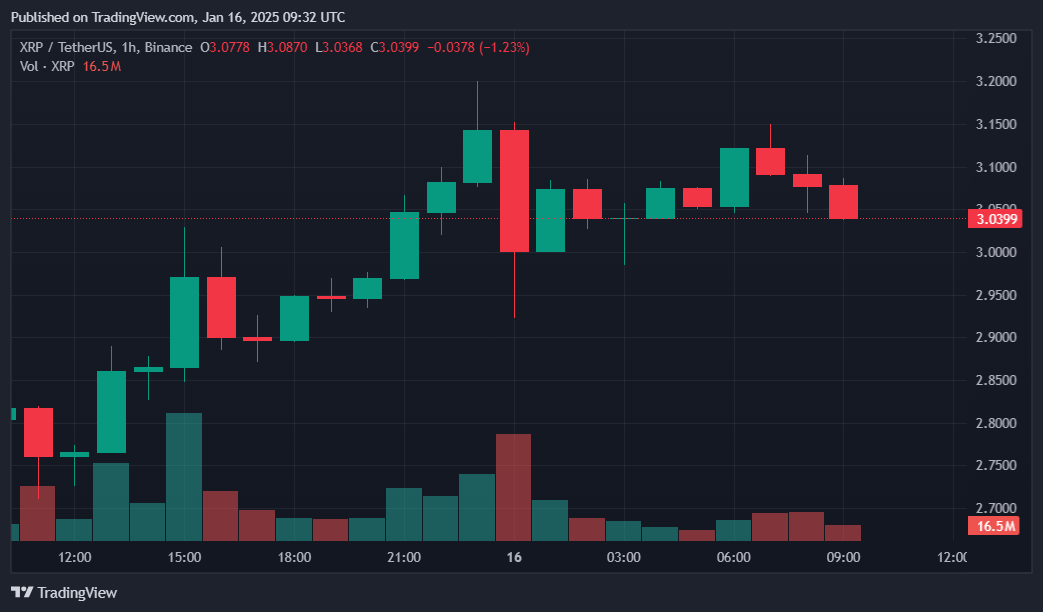

Ripple (XRP) surged more than 16% from a 24-hour low of $2.73 to an intraday high of $3.17 on January 16, pushing its market capitalization to $178 billion and consolidating its position as third largest cryptocurrency after Bitcoin (BTC) and Ethereum (ETH).

At press time, XRP was up 8.4%, supported by a overvoltage in commercial activity. The token’s 24-hour trading volume reached $23.8 billion, an increase of 79.40% from the previous day.

Why is XRP increasing?

XRP’s recent rally, which initially began on December 30 when the altcoin reached a psychological support level of $2, was primarily fueled by optimism surrounding President-elect Donald Trump’s inauguration on January 20, which will bring highly anticipated results. changes to the Securities Exchange Commission.

The SEC trial against Ripple, launched in December 2020, accused the company of conducting unregistered securities offerings through sales of XRP. Under the current SEC Chairman, Gary Genslerthe matter was the subject of protracted litigation.

Gensler set to step down as SEC chairman on January 20, with pro-crypto advocate Paul Atkinsa Trump nominee, is preparing to take over. This change in direction has fueled speculation that the SEC may drop its appeal in the Ripple lawsuit, potentially paving the way for a favorable settlement and lifting the regulatory cloud that has long hung over XRP and also increasing the likelihood of a XRP Spot ETF obtain approval.

Additionally, Ripple CEO Brad Garlinghouse previously noted that Trump’s election victory was already having a positive effect on Ripple, with the company signing more deals in the last six weeks of 2024 than in the six previous months. See below.

Beyond hopes for regulatory clarity, the broader growth of the Ripple ecosystem has also played a pivotal role in boosting positive investor sentiment around the altcoin while expanding the network’s utility.

Notably, Ripple’s dollar-pegged stablecoin RLUSD, launched in mid-December 2024, has already exceeds several of its competitors like PayPal’s PYUSD and Justin Sun’s USDD, Frax.

Roughly a month after its launch, the stablecoin has accumulated over $72 million in market capitalization and had a 24-hour trading volume of $141 million at the time of writing. In comparison, PYUSD, launched in 2023, saw 24-hour trading volume reaching $24 million.

At the same time, the growing popularity of Ripple Coins like XRP ARMY, which is up over 186% in the past week, and Britto, which is close behind with weekly gains of over 87%. Other memes, like PHNIX and LIHUA, also saw double-digit gains.

Whales have also contributed to XRP’s bullish momentum. According to data from analytics platform Santiment, wallets containing between 1 and 10 million XRP tokens have accumulated more than $3.8 billion worth of XRP since November 12, as noted in a January 15 report. job on X.

XRP could rally to $10: analysts

With the aforementioned factors and Bitcoin’s resurgence above $100,000 continued US CPI data colder than expectedMarket analysts expect XRP’s rally to continue in the coming days and surpass its previous all-time high, with many forecasting a potential rise to a new all-time high of $10.

According to analyst Ali Martinez, XRP was currently in the midst of a “massive bullish breakout.” In a recent MessageHe explained that recent whale accumulation and retail buying helped the altcoin break out of a bullish pennant, which positions the token at a price that could push it to $10.

“XRP Whale”, a widely followed member of the XRP community, also sharp to a similar target.

At the time of writing, XRP was approximately 9% below its all-time high of $3.40, reached in January 2018.

Post Comment