‘Try harder hackers’; ADA suffers breach on X

Cardano holders received a warning on Sunday: ADA trading will stop on all platforms starting Monday, December 9. There’s only one problem: it wasn’t true.

“It seems that [Cardano Foundation] The account has been hacked,” Cardano CEO Charles Hoskinson said in an X article on Sunday. “Try harder hackers.”

Hoskinson’s comment came after the Cardano Foundation’s X account posted a cryptic message that the nonprofit would cease all support for its native cryptocurrency, ADA, effective immediately.

In the false statement, the foundation cites “unexpected legal action” from the U.S. Securities and Exchange Commission (SEC).

“We have made the difficult decision to immediately cease all support for the $ADA token to ensure compliance with regulatory requirements,” the foundation apparently said. See the hacker’s statement below.

All ADA tokens will “therefore be burned,” community members were incorrectly told.

Background on Cardano and its CEO

Hoskinson founded Cardano in 2017 and has become a prominent figure in the crypto industry.

The platform operates on a proof-of-stake consensus mechanism, known for its emphasis on scalability, sustainability, and security. Cardano has been widely considered a “third generation” blockchain designed to overcome the limitations of earlier networks like Bitcoin and Ethereum.

The foundation’s perceived cessation of support for the ADA seemed to suggest that it was prioritizing regulatory compliance, likely in hopes of mitigating additional penalties.

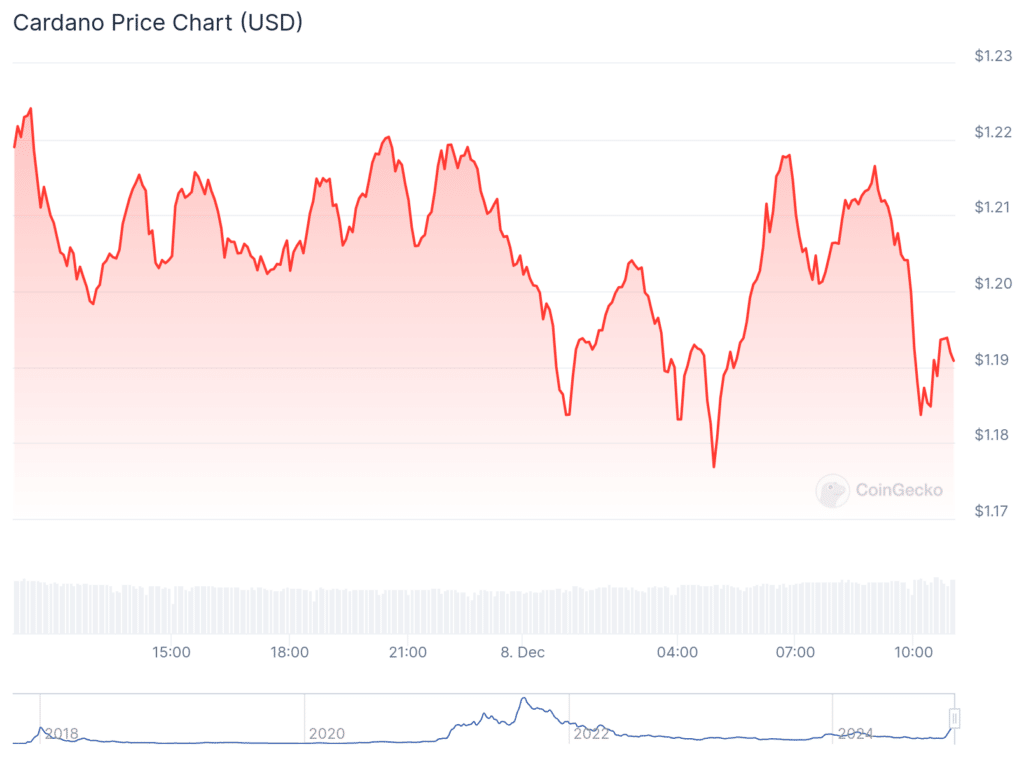

Cardano Price Chart

The fake SEC lawsuit came as the price of Cardano’s token turned red as community members who were duped saw the news as another legal blow to the cryptocurrency industry, which has been subject to increased regulatory scrutiny throughout 2024.

The fact that specific allegations had not yet been disclosed was a clear sign that the lawsuit was false.

The fake lawsuit seemed legitimate on the surface, given that there is no shortage of similar lawsuits against other blockchain projects and crypto-related companies.

In 2024 alone, the SEC continued its efforts to combat crypto-related schemes, targeting fraudulent activity and unregistered offerings. Here are some notable cases:

- NovaTech Ltd. ($650 million fraud): The SEC charge NovaTech for conducting a multi-level marketing and crypto investment fraud, affecting over 200,000 investors worldwide. The scheme promised safe and profitable investments in the crypto and foreign exchange markets, but primarily operated as a Ponzi scheme.

- CryptoFX ($300 Million Ponzi Scheme): Seventeen people have been indicted for their roles in a fraudulent scheme targeting the Latino community. The scheme falsely promised high returns on crypto and currency investments, but instead diverted funds to pay previous investors and enrich the organizers.

- Maverick Protocol: The SEC alleged that this decentralized finance (DeFi) platform offered unregistered securities. The accusations highlighted the continued scrutiny of DeFi projects that can circumvent traditional regulatory frameworks.

- Gemini Earnings Program: The SEC sued Gemini over its Earn program, claiming the product was an unregistered securities offering. The case focused on investor protection for crypto lending products.

Additionally, the SEC has examined Cardano in the past. In 2023, the agency Understood ADA in its lawsuits against Binance and Kraken, alleging that the token operated as an unregistered security under U.S. securities laws.

This classification places ADA under the regulatory scope of the SEC, requiring compliance with securities brokerage and registration rules if upheld by the courts.

X security to blame?

Since the takeover of X (formerly Twitter) by Elon Musk, concern has grown about the proliferation of security breaches.

High-profile incidents include the compromise from the SEC’s official X account earlier this year.

Observers have raised alarms over the platform’s ability to protect user data and maintain account security and blamed Musk’s deep staff cuts, including in the information security team .

The platform’s security issues have persisted under Musk’s leadership, with critics pointing out that these breaches could have long-term implications for the platform’s credibility, especially since it hosts government agencies, businesses and influential personalities.

These concerns are compounded by Musk’s previous legal troubles, including an SEC lawsuit over his influence over Dogecoin prices, which has only added to the platform’s instability.

Post Comment