Crypto Investment Product Inflows Break Records at $3.85B

Last week, digital asset investment products recorded their highest weekly inflows on record, amounting to $3.85 billion.

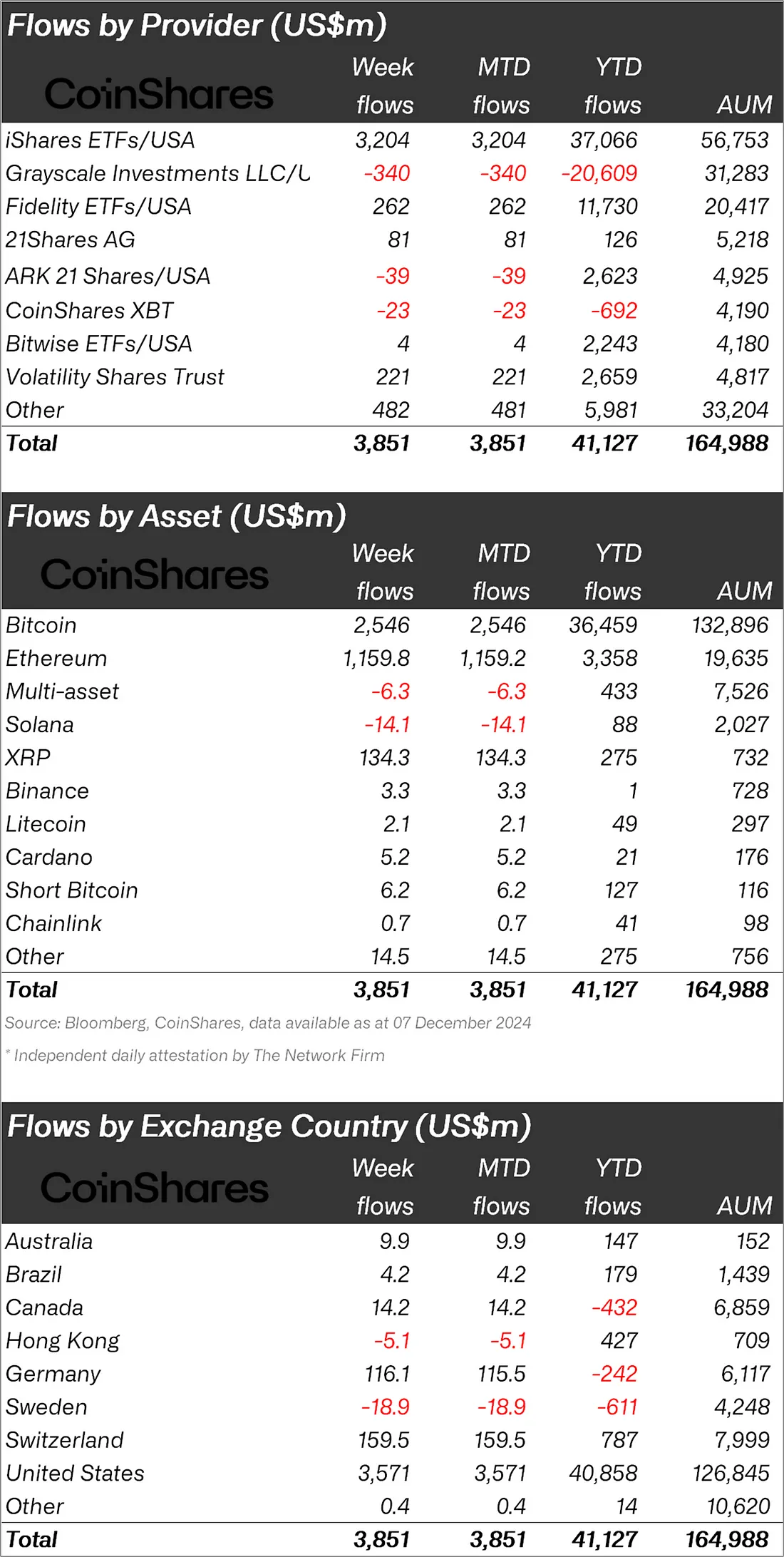

According to Coin Sharesinflows into digital asset investment products hit a record high of $3.85 billion last week, bringing the annual inflow to $41 billion so far. This figure surpasses the recent high of $2.7 billion, signifying a historic period of investor confidence in the market.

Bitcoin (BTC) continues to be the top asset, generating $2.55 billion in inflows. Positive flows in Ripple (XRP) and Litecoin indicate a broad allocation of capital between digital assets. Ethereum saw its largest weekly inflow since the start of the year at $1.2 billion. In comparison, $14 million in capital flowed out of Solana (GROUND), reflecting a change in investor orientation. Blockchain stocks, as a whole, also saw inflows of $124 million, which is the highest since January.

Regionally, the United States maintained its dominance in terms of total inflows with $3.57 billion, followed by Switzerland with $159.5 million. Total assets under management in digital asset investment products now stand at $165 billion thanks to new inflows.

The massive momentum witnessed by the crypto market is likely due to two major events. President-elect Donald Trump named venture capitalist David Sacks as the White House’s first-ever AI and crypto czaras part of its strategy to make the United States the global leader in cryptocurrency innovation. Sacks will be responsible for developing rules and developing laws for AI and cryptography, as well as chairing the President’s Council of Advisors on Science and Technology. Another reason is the chairman of the Federal Reserve That of Jérôme Powell BTC support. On December 5, Powell said that BTC was seen as a competitor to gold, not the dollar, at the DealBook Summit 2024.

These pro-crypto measures under the leadership of future President Donald Trump not only boosted the morale of crypto investors in the market but also increased Trump’s popularity. Many bettors believe Trump has a 82% chance to win the Time Person of the Year 2024 on Polymarket, a popular prediction market.

Post Comment